The Ultimate Guide to the Best Real Estate Cities in the US

As the US housing market evolves in response to economic shifts, employment trends, and migration patterns, five cities have emerged as front-runners for real estate growth. Whether you’re a homebuyer, investor, or looking to relocate, here’s a breakdown of the most promising urban markets in early 2025.

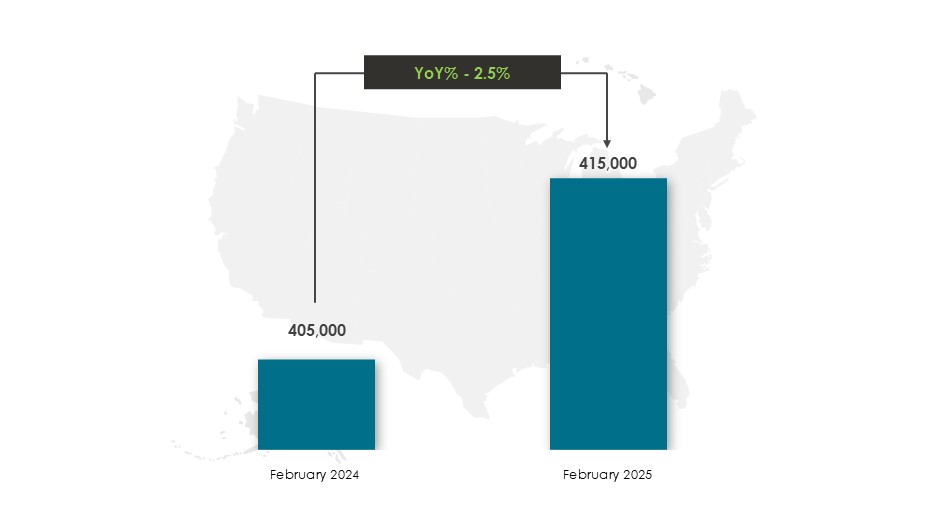

Orlando, Florida

Despite a dip in listings (median price at $370K, down 4.6% YoY), Orlando saw a modest 2.5% increase in median home sale prices ($415K in Feb 2025). The city remains resilient, fueled by its strong tourism economy, business expansion, and no state income tax. While home sales dipped by 15.9%, job growth held steady with a 0.2% rise in employment. Inbound searches were led by residents from New York, Washington, and Miami.

Feb-24 vs Feb-25 ($)

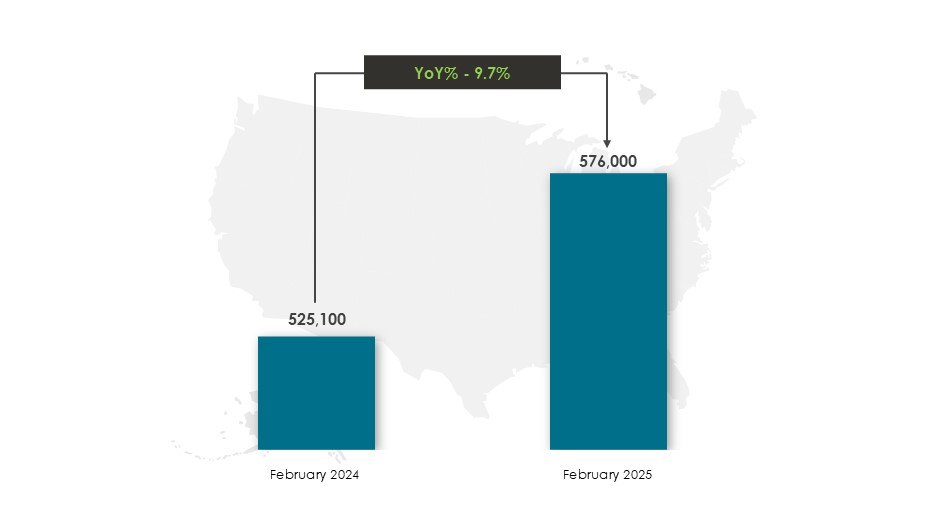

Salt Lake City, Utah

Salt Lake City is proving to be a hotbed for real estate investment, boasting a 9.7% YoY growth in home prices to $576K. The city’s appeal lies in its balance of affordability and quality of life, especially for those priced out of West Coast metros. Despite a tight inventory, home sales rose 2.6%. Employment grew 1.8%, buoyed by strong tech, healthcare, and finance sectors.

Feb-24 vs Feb-25 ($)

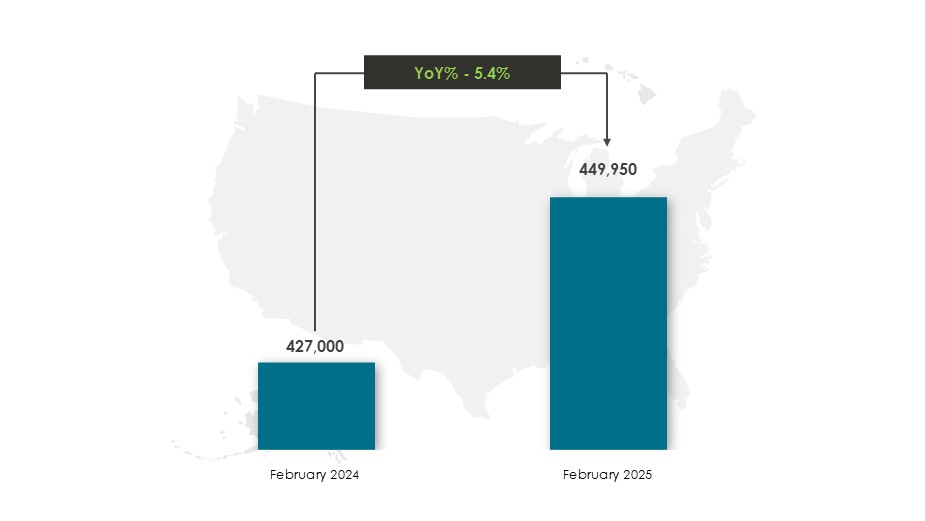

Tampa, Florida

Tampa is a fast-rising star with 5.4% growth in median home prices, climbing to nearly $450K. Favorable weather, job creation (0.22% growth), and demand from both locals and out-of-state investors are driving this surge. The city’s strong healthcare and professional services sectors support steady home sales, which increased 1.7% year-over-year.

Feb-24 vs Feb-25 ($)

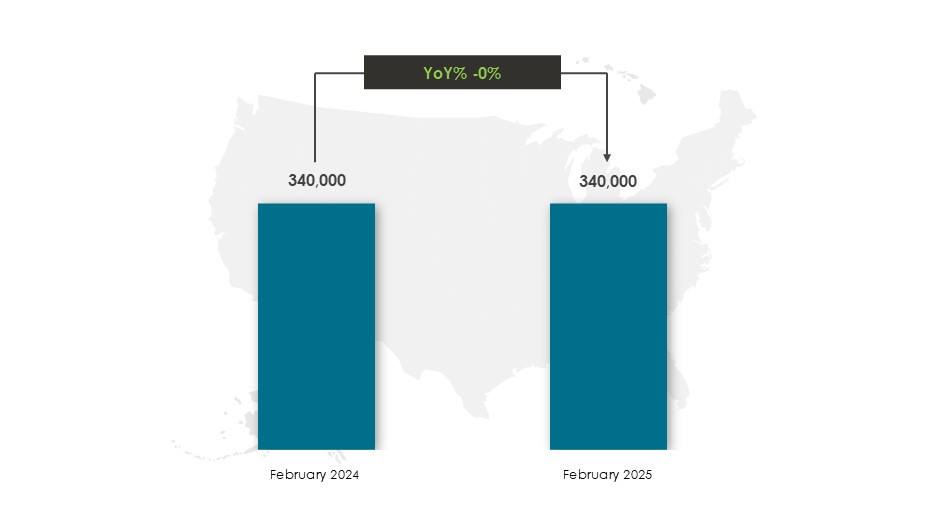

Houston, Texas

In contrast to other booming cities, Houston’s housing market remains stable, with no change in median home prices (holding at $340K). Though home sales fell slightly (down 2.2%), the city’s vast economy, led by energy and manufacturing, recorded a 0.5% job growth. Houston’s affordability and diversity make it a consistent performer, attracting interest from across the country.

Feb-24 vs Feb-25 ($)

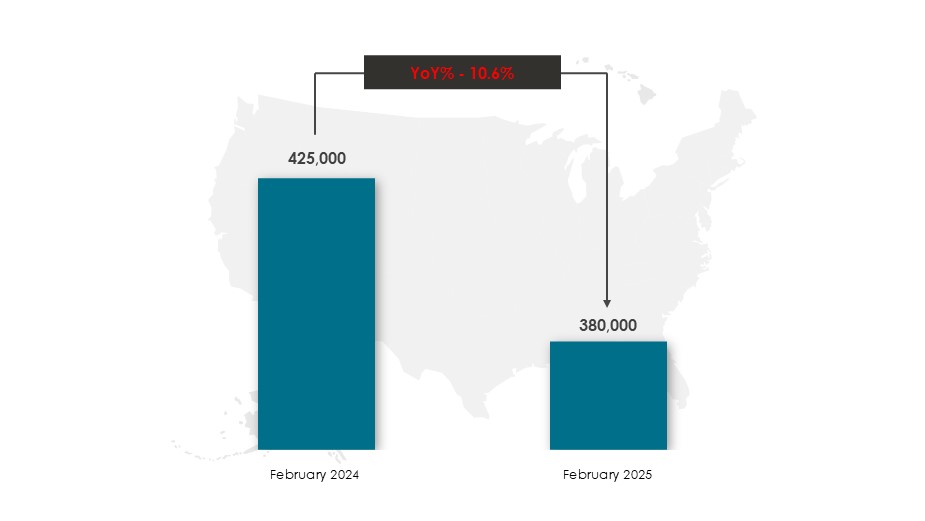

Atlanta, Georgia

Atlanta presents a contrasting trend, with a 10.6% drop in home prices ($380K) due to rising mortgage rates and a growing housing inventory. Home sales fell by 8.1%, and employment declined marginally by 0.09%, signaling a cooling market. Still, Atlanta’s long-term potential remains strong given its large metro size and business base.

Feb-24 vs Feb-25 ($)

Stay tuned to Innovius Research for ongoing market insights and data-driven analysis.

Data Sources: PWC, IBISWorld, Redfin, and others

Read more Market Reports.

Other Market Insights