Saudi Arabia Online Food Delivery Market

Introduction

Online Food Delivery is a courier service that allows retailers, restaurants, or third-party applications to deliver food to clients on demand. Online food orders can be placed using mobile applications, websites, or over the phone. Online food delivery services provide better convenience to consumers as they allow customers to navigate through multiple restaurants, food items, and cuisines at a single point of contact.

Market Overview

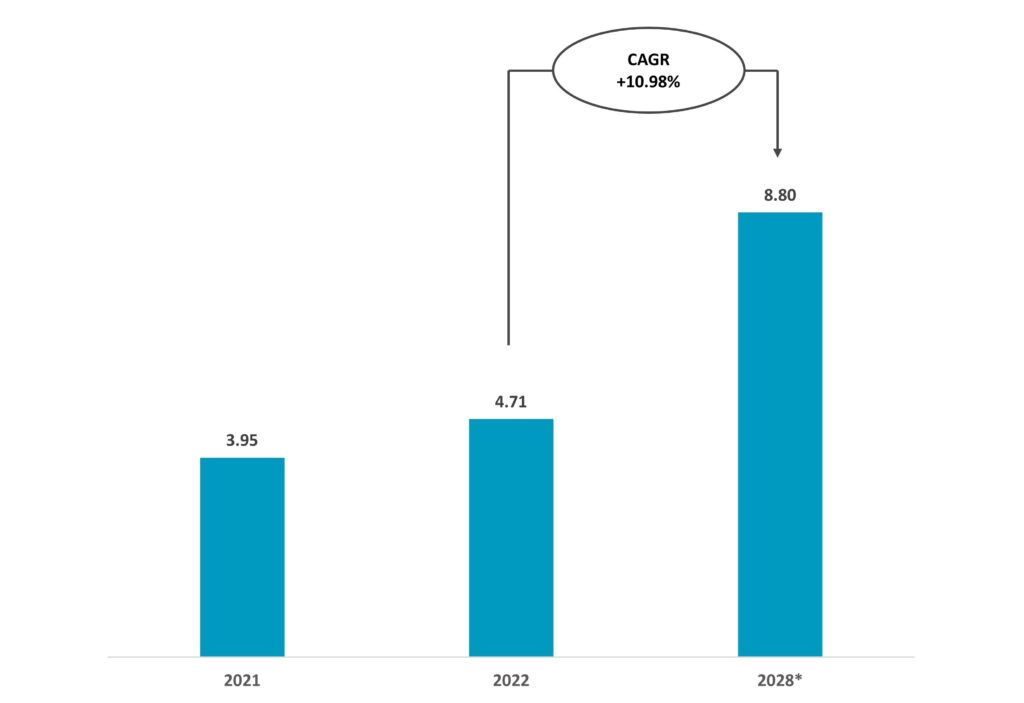

The market for online food delivery in Saudi Arabia was worth $3.95 billion in 2021. The online food delivery market is expected to develop and reach $8.80 billion by 2028, with a value of $4.71 billion in 2022. The Saudi Arabia Online Food Delivery Market is anticipated to expand at a roughly 10.98% CAGR between 2022 and 2028. Digitization and the development of sophisticated online meal ordering systems are the main drivers of market expansion.

Present Market Trends

Positive Impact of Covid-19 on the Market

➟ Due to Covid-19, Saudi Arabia has witnessed double-digit growth in orders of online food delivery.

➟ The inclination of customers for food delivery apps grew during the pandemic due to the ease of home delivery of restaurant-made food and online payment options for safe and contactless payments.

➟ During the Pandemic, online food delivery companies used outreach initiatives to assure their clients of the safety and reliability of their products.

Government Initiatives to Boost Food Delivery Sector

➟ Saudi Arabia’s government is encouraging economic development through investing in food delivery services. As a result of such initiatives and campaigns, food delivery jobs and companies have been developing in Saudi Arabia.

➟ In 2021, The Communications and Information Technology Commission (CITC) and the Social Development Bank (SDB) signed a three-year joint partnership agreement to finance self-employed individuals by allowing them to own private vehicles to work in food delivery applications.

Major Online Food Delivery Acquisitions in the Market

➟ In Saudi Arabia, there is an increasing acquisition of food delivery companies to improve positions in the market.

➟ In 2022, the Saudi food delivery platform Jahez signed an agreement to acquire Chefz, one of its major rivals in the region to strengthen its position in the fast-growing online food delivery market in Saudi Arabia.

➟ In 2022, Taker, a Saudi Arabia-based food tech acquired Brisk Delivery to expand its TakerGo platform, which provides a delivery solution that connects restaurants to major Saudi delivery service providers.

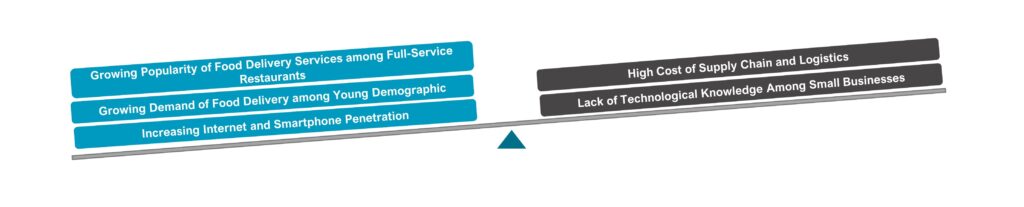

Market Dynamics

Data Sources: Statista, Blinko, GlobeNewswire, and others

Get in-depth Market Research for any industry to understand the Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Must Read