Global Fintech Market – Market Dynamics & Statistics

In our previous article on the Global and Indian Fintech Market, we delved into the exciting growth and potential of both the Global and Indian Fintech market, uncovering the forecasts and talent attraction that are reshaping the financial landscape. Now, it’s time to go beyond the surface and dive deeper into the crucial aspects that drive this thriving sector forward.

In this article, we shift our focus to the dynamics and statistics that underpin the Global Fintech Market. Join us on this insightful journey as we unravel the market’s driving forces, confront the challenges, and gain valuable insights that will navigate us through the rapidly evolving landscape of financial technology.

Drivers and Challenges

Drivers

➟ Surge in Mobile Banking and Financial Solutions

The increasing use of mobile devices has been a significant driver for the global fintech market. With the widespread adoption of smartphones and the growing accessibility of the internet, more people have the means to access financial services and solutions through their devices.

According to a report by Statista, the number of operating mobile devices worldwide was almost 16 billion in 2022, representing a massive potential user base for fintech companies.

➟ Advancements in AI and Blockchain Technologies in Fintech

The rapid advancements of artificial intelligence (AI) and blockchain technologies have revolutionized the fintech landscape. AI-powered chatbots, robo-advisors, and blockchain-based decentralized finance (DeFi) platforms have been reshaping financial services delivery, attracting significant investments, and driving fintech innovation.

➟ Crypto-Focused Fintech Solutions in the Global Market

The growing interest in digital assets and cryptocurrencies has fueled the development of fintech solutions in the crypto space, attracting investors and driving market expansion. These fintech solutions offer crypto wallets, and staking, providing users access to various crypto-related financial products and investment opportunities.

Challenges

➟ Infrastructure and Connectivity Barriers in the Fintech Market

In certain regions, inadequate digital infrastructure and limited access to the internet can hinder the adoption of fintech services, limiting market penetration and user reach.

Additionally, the lack of standardized systems in some regions can create compatibility issues between fintech platforms and legacy financial systems, further complicating the expansion of fintech services in these areas.

➟ Regulatory Compliance Complexity in the Global Fintech Market

Fintech companies face the challenge of navigating complex and ever-changing regulatory frameworks across various jurisdictions. Data protection, anti-money laundering (AML), and payment regulations require substantial resources and expertise.

Failure to comply may lead to legal penalties and reputational damage, making regulatory compliance a crucial concern for fintech firms to sustain growth and innovation.

Statistics

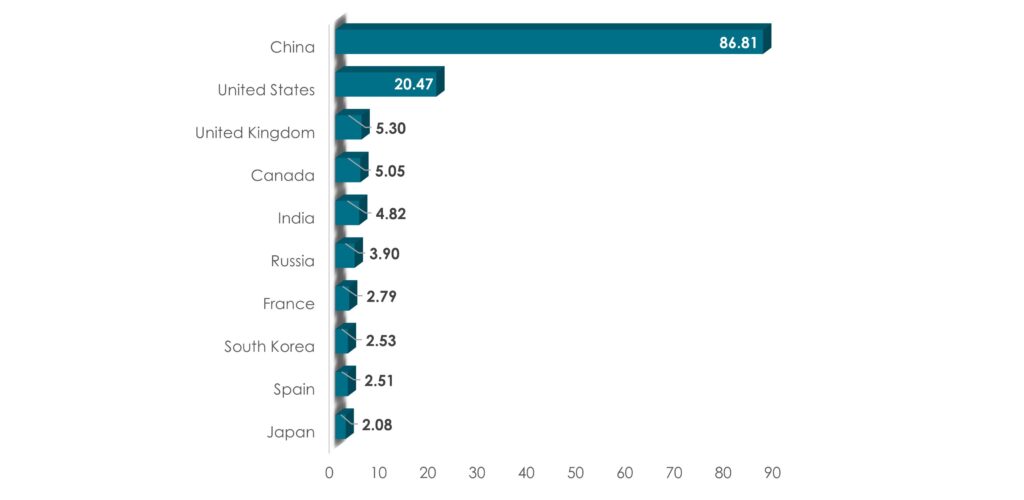

➟ User-Based Contactless Card Payments in 2022

As of 2022, China has been at the peak with $86.81 billion in contactless card transactions, followed by the United States with $20.47 billion. Other significant countries include the United Kingdom, Canada, and India, with $5.3 billion, $5.05 billion, and $4.82 billion, respectively.

The number of contactless payment transactions in China has been estimated to be four times higher than in the United States, indicating a significantly higher user adoption rate for contactless payments in China.

➟ Consumer Fintech Adoption: Global Money Transfers and Payments

According to Statista’s data from 2021, the consumer fintech adoption rate for global money transfers and payments stands at 75%.

It indicates a significant shift towards fintech solutions as users increasingly opt for digital and mobile-based methods for conducting financial transactions worldwide.

➟ Fintech Adoption Across Diverse User Segments

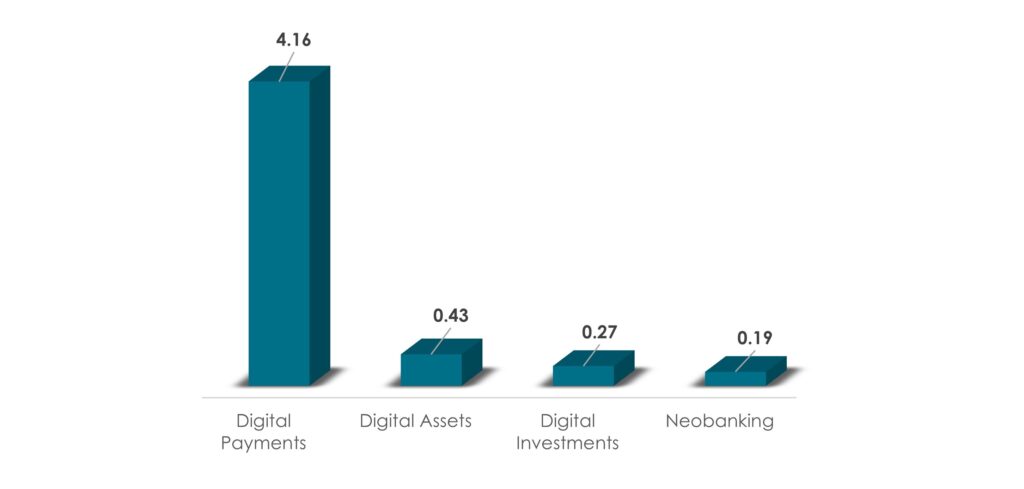

In 2022, the global fintech market witnessed significant user adoption, with 4.16 billion users for Digital payments, 0.43 billion for Digital Assets, 0.27 billion for Digital Investments, and 0.19 billion for Neo banking.

➟ Proximity Mobile Payments Adoption Across Global Markets

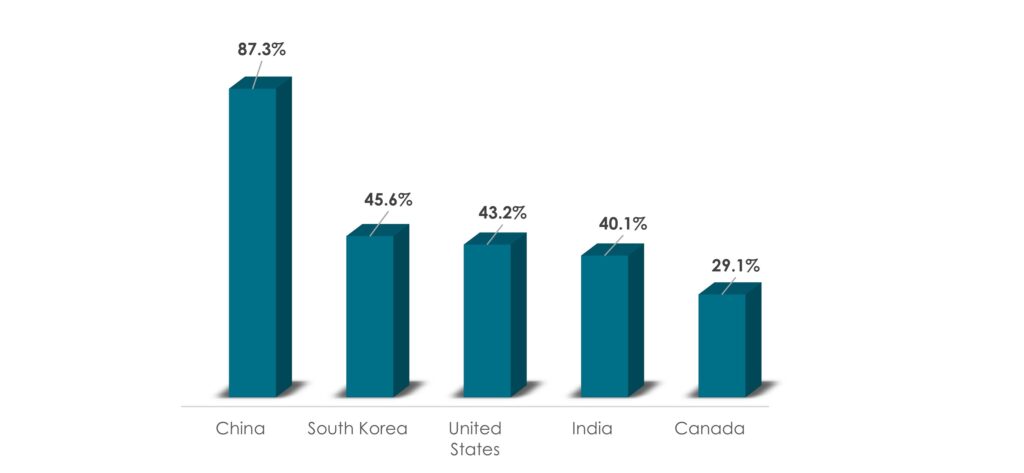

In 2021, the adoption of proximity mobile payments exhibited significant variations among five key countries. China emerged as the major player, with 87.30% of smartphone users, and South Korea, with 45.60%, while the United States, India, and Canada recorded adoption rates of 43.20%, 40.10%, and 29.10%, respectively.

The high adoption rates of mobile payments in China and South Korea, along with considerable rates in the United States, India, and Canada, underscore the global impact of mobile technology in reshaping payment behaviors.

➟ Global Fintech Adoption: Online and Mobile Payments

In 2022, 75% of global consumers have embraced fintech services for online and mobile payments.

This substantial adoption rate highlights the increasing reliance on fintech platforms for conducting worldwide secure and convenient financial transactions.

➟ Explosive Growth in Global Blockchain Wallet Users

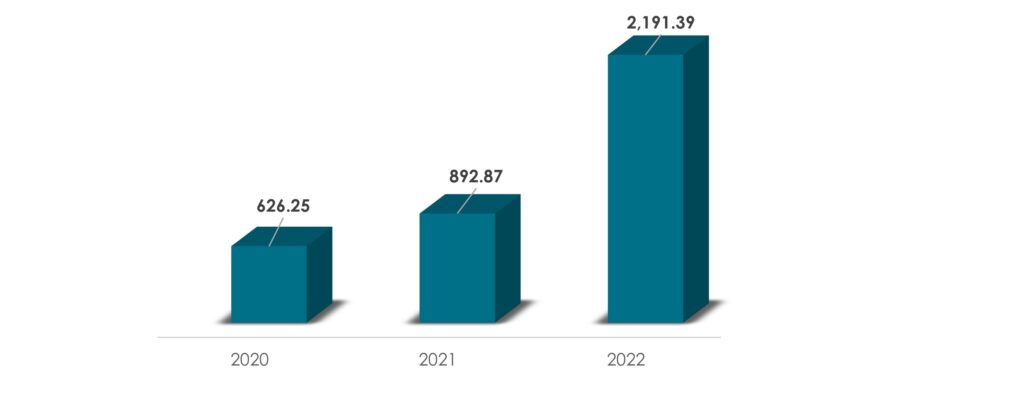

The number of blockchain wallet users witnessed impressive growth, rising from 626.25 million in 2020 to 2,191.39 million in 2022. This significant surge reflects blockchain’s transformative impact on the global fintech market.

(Millions)

MUST READ: Global and Indian Fintech Market

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more insights here.

Data Sources: BCG, Statista, Industry ARC, Yoh, Robert Walters Group, Indigohire, Global Market Estimates, Techfunnel, and others

Get in-depth Market Research for any industry to understand the Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights