Exploring the Growth of Herbal Tea Market in the USA Market

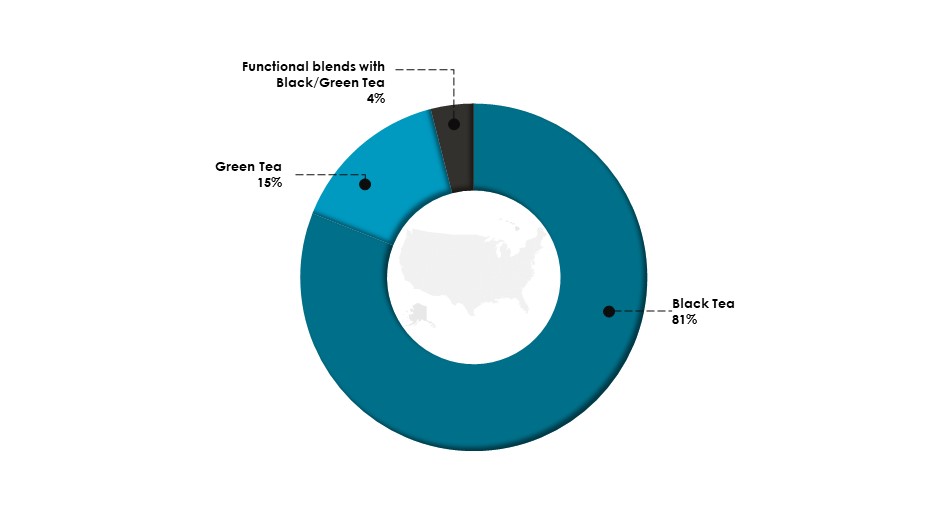

In 2023, the US Herbal Medicine Market strongly preferred traditional tea flavors. Black tea dominated with 81% market share, while green tea held a respectable 15%.

Functional blends, combining black or green tea with health-promoting ingredients, represented 4% of the market. This data reflects enduring consumer interest in classic tea flavors alongside a growing trend towards functional blends.

From 2017 to 2023, Rooibos, Peppermint, Ginger, and Chamomile emerged as the most preferred herbal tea flavors among organic product launches in the US.

In 2023, Bigelow Tea launched three new flavours, Whispering Wildflowers Herbal Tea plus L-Theanine, Peak Energy Black Tea plus extra L-Theanine, and Caffeine, and Ginger Honey Herbal Tea plus Zinc with functional blends that resonate with health-conscious consumers.

Additionally, in response to increasing consumer demand for wellness-oriented products, Bigelow Tea introduced a new addition to its line of Bigelow Benefits teas in the US: Throat Defense Ginger Honey Lemon Herbal Tea, further expanding its offerings in the wellness tea segment in 2023.

Organic/ Herbal Tea Sales Witnessed a Steady Growth in the US Market

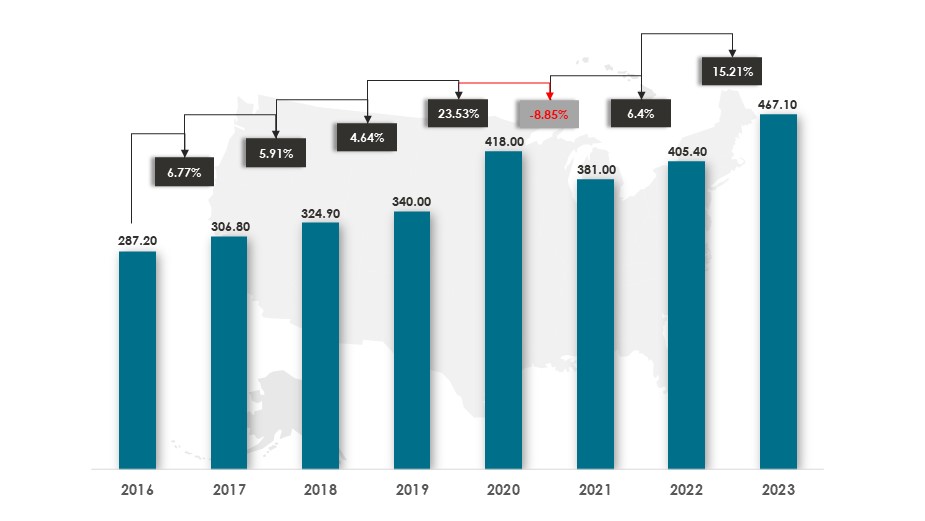

In 2020, organic/ herbal tea sales in the US experienced a notable surge, reaching $418 million. From 2016 onwards, organic/herbal tea sales witnessed steady growth in the US market, representing the consumers’ growing interest towards healthy living.

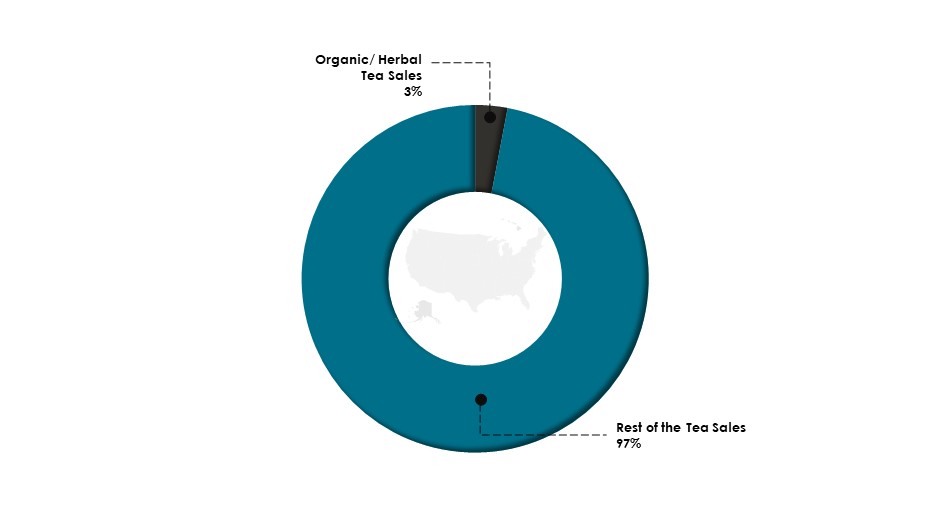

According to IBISWorld, in 2023, organic/ herbal tea sales in the US account for approximately $467.1 million, a 15.21% increase from $405.40 million in 2022 with a 3% share.

Adaptogens Used in Tea/Coffee – Statistics

Adaptogens Products Used in Tea/ Coffee Beverages

According to Spoonshot research in 2022, supplements account for 35% of adaptogens product formats on the market, but beverage formats such as tea, coffee, and energy drinks are also prevalent.

Drilling down further, 23% of adaptogen products on the market are in the form of tea, while 7% are in the form of functional coffee. All beverage formats combined (tea, coffee, juice and smoothies, drink mixes, and energy drinks) account for 44% of the adaptogens industry.

Companies Blending Adaptogens in Beverages

Several North American companies are launching adaptogenic beverages to meet the increased demand for better-for-you beverages.

Four Sigmatic announced the release of ground coffee extracted from adaptogenic mushrooms in July 2022. In 2023, the company further launched three new Think Organic Coffee SKUs at Whole Foods Market, including Think Organic High Caf Coffee, Ground, Think Organic Coffee, Ground, and Think Organic Coffee, Whole Bean.

US Herbal Tea Consumption

According to divineingredients.com, herbal tea consumption in the US surpassed that of black, green, and white tea combined, indicating a significant preference for herbal varieties among American consumers.

Moreover, a survey of 300 respondents revealed that 89.3% consumed herbal tea in 2023 for various health purposes, including infection prevention and treatment, underlining the widespread adoption of herbal tea as a wellness beverage within the US market.

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more on Food & Beverages

Data Sources: Bevindustry, Statista, GlobeNewsWire, TheHill, and others.

Get in-depth Market Research for any industry to understand this industry in more detail where we will cover Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights