Dental Implantology Market: Redefining Dental Care on a Global Scale

The Global Dental Implantology Market is a dynamic sector encompassing surgical procedures and prosthetic solutions for replacing missing teeth.

With advancements in technologies and a growing demand for aesthetic dental treatments, the market has witnessed substantial growth, driven by factors such as ageing populations and increasing oral health awareness.

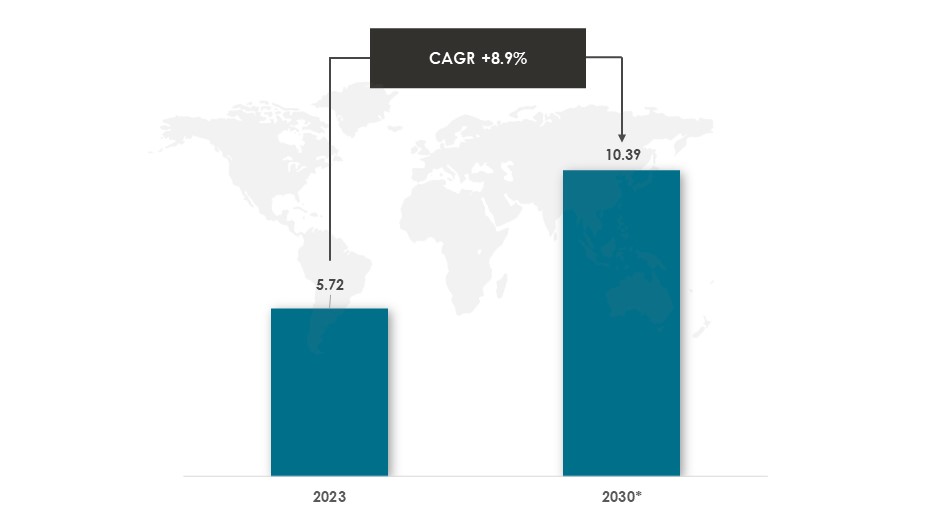

Global Dental Implantology Market Growth and Forecast

In 2023, the Global Dental Implantology market was valued at $5.72 billion. The market is expected to increase and reach approximately $10.39 billion by 2030.

During the forecast period, the market will be growing at an approximate CAGR of 8.9%.

The growth is fueled by increasing use in therapeutic areas, rising demand for prosthetics, and the limitations of removable prosthetics, which drive adoption among patients and surgeons.

Developments

In 2023, Straumann acquired GalvoSurge, a Swiss-based dental medical device manufacturer. GalvoSurge is known for its implant care and maintenance solutions, including the GalvoSurge Dental Implant Cleaning System GS 1000.

This system received CE marking in 2020 and targets peri-implantitis treatment, showcasing ongoing innovations in the global dental implantology market.

In 2023, T-Plus launched its ST implant system in the Chinese market following an 8-year registration process with the NMPA.

The system, featuring bone- and tissue-level implants, met diverse clinical needs and adhered to Straumann’s quality standards, marking a significant development in the global dental implantology market.

In 2023, Nobel Biocare strategically partnered with Mimetis Biomaterials and introduced creos syntogain, a biomimetic bone graft substitute. This product, formerly known as MimetikOss in Spain promoted bone regeneration.

The collaboration expanded Nobel Biocare’s regenerative solutions portfolio, strengthening its position as a preferred supplier for organic or synthetic regeneration needs.

In 2023, Dentsply Sirona introduced the DS OmniTaper Implant System® at the EAO Congress, offering enhanced treatment options. The EV Implant Family, including Astra Tech Implant System and DS PrimeTaper Implant System®, provided versatile solutions for various indications.

These systems featured a conical EV connection, promoting restorative clarity and compatibility with digital workflows. OsseoSpeed® implant surface further improved bone healing, strengthening bone-to-implant bonding. The innovations reflected Dentsply Sirona’s commitment to delivering advanced dental implant products.

In 2022, Envista Holdings Corporation announced the completion of acquiring Carestream Dental’s Intraoral Scanner business, rebranded as DEXIS under the Envista Equipment and Consumables Segment.

This addition brought world-class intra-oral scanners critical to digital workflows for dental procedures such as implants and aligners, aligning with Envista’s mission of advancing dental care through digital solutions.

Must Read The Rising Demand for Dental Implantology: Statistics and Trends Worldwide

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more on Healthcare

Data Sources: Precedence Research, Polaris Market Research, Fortune Business Insights, Data Bridge Marketresearch, and others

Get in-depth Market Research for any industry to understand this industry in more detail where we will cover Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights