The Rising Demand for Dental Implantology: Statistics and Trends Worldwide

Global Dental Implantology Market: 2022 Type Distribution Analysis

In 2022, the Global Dental Implantology Market was dominated by Endosteal Implants, accounting for 40% of the market share.

These implants were widely adopted for their safety, effectiveness, and versatility, offering improved stability and durability.

Subperiosteal Implants held a significant share at 39%, while Transosteal Implants faced challenges due to their complex and invasive nature, representing only 4% of the market. Other implant types accounted for the remaining 17% share.

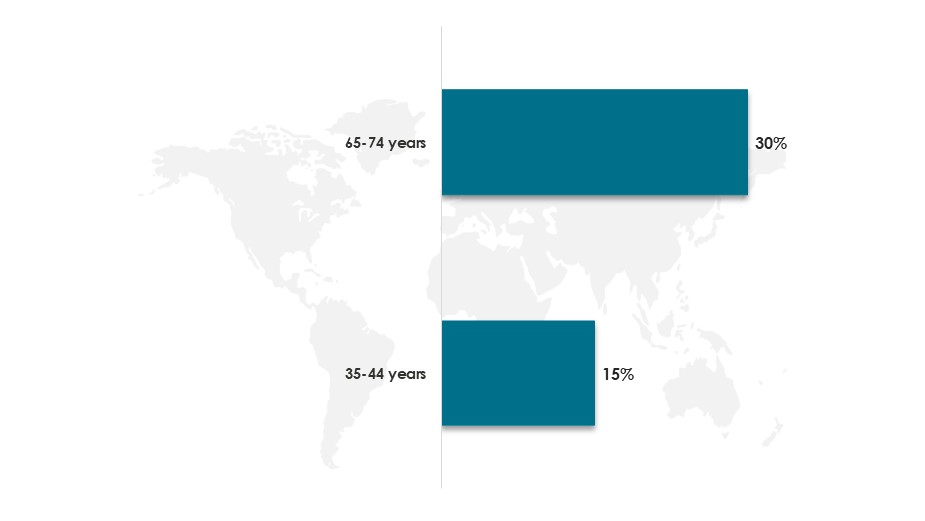

Analysis of Tooth Loss Trends and Market Growth Factors in 2023

According to World Health Organization (WHO) estimates, in 2023, severe dental disease leading to tooth loss affected 15% of middle-aged adults (35-44 years).

Additionally, the ageing population significantly contributed, with around 30% of individuals aged 65-74 experiencing complete tooth loss.

These trends, combined with the increasing incidence of dental diseases such as dental caries (tooth decay), oral cancers and periodontal issues, significantly drove the dental implant market growth.

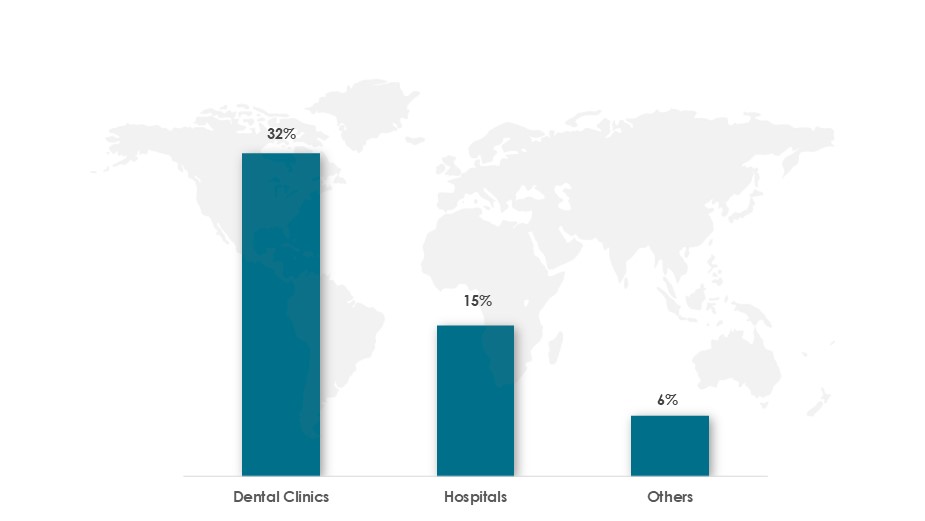

Global Dental Implant Market End-Use Distribution Analysis in 2022

In 2022, the Global Dental Implantology Market exhibited notable trends in end-use distribution.

Dental clinics dominated with a 32% market share, reflecting their pivotal role in implant procedures.

Hospitals accounted for 15%, highlighting their significant contribution to implant placements.

The remaining 6% was attributed to other end-use sectors, indicating a diverse landscape in implantology service provision.

Market Influences on Dental Implant Success and Demand

According to the American Academy of Implant Dentistry, in 2022, approximately 3 million Americans had at least one dental implant, driving market demand.

This surge was fueled by the implants’ high success rate of around 95%, attributed to their biocompatible nature and longevity, lasting a lifetime with proper care compared to prostheses lasting up to 12 years.

These statistics underscored a significant trend in the Global Dental Implantology Market, highlighting the increasing preference and confidence in dental implant procedures.

Strategic Partnerships of Zest Dental Solutions in 2022

In 2022, Zest Dental Solutions entered into two significant partnerships.

In January 2022, Zest partnered with Aspen Dental, effective immediately, encompassing over 930 locations in over 45 states.

Further, in February 2022, a 3-year agreement with Dental Whale Membership was established, supporting over 19,000 Dental Whale offices across the United States.

These partnerships aimed to provide Zest’s advanced implant solutions, including LOCATOR and LOCATOR R-Tx, reflecting a strategic trend in expanding access to innovative dental implant technologies in the Global Dental Implantology Market.

Read Dental Implantology Market: Redefining Dental Care on a Global Scale

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more on Healthcare

Data Sources: Precedence Research, Polaris Market Research, Fortune Business Insights, Data Bridge Marketresearch, and others

Get in-depth Market Research for any industry to understand this industry in more detail where we will cover Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights