Electronics Manufacturing Services: Surging Ahead on the Path of Growth

Electronics Manufacturing Services (EMS) refers to an array of solutions, including the design, manufacture, testing, distribution, and provision of return/repair services tailored to fulfill the specific needs of Original Equipment Manufacturers (OEMs) in the electronics industry.

The global EMS market is segmented across various sectors, including Computer, Consumer Electronics, Aerospace & Defense, Medical & Healthcare, Automotive, Semiconductor Manufacturing, Robotics, and others.

The increasing integration of circuit boards in tablets and electronic gadgets, driven by advancements in technology and consumer preferences for compact and multifunctional devices, is expected to drive market growth within the EMS industry.

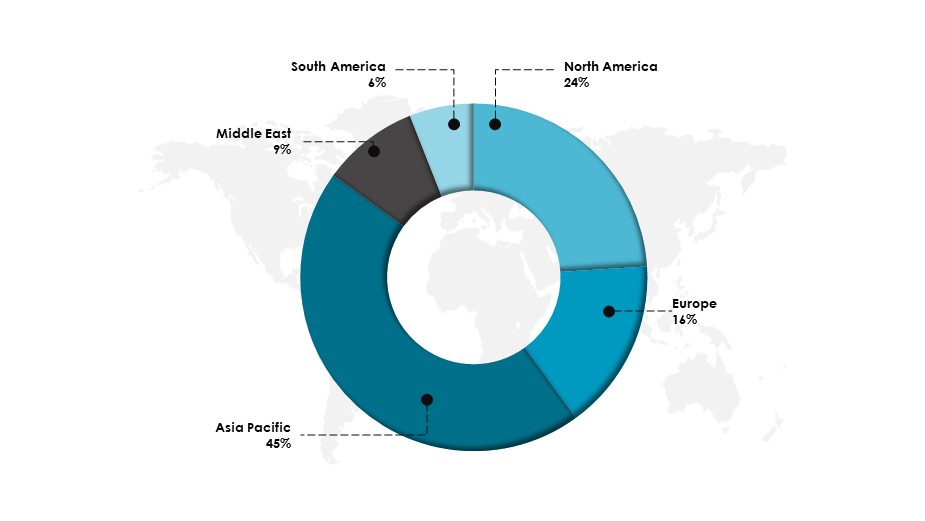

Electronic Manufacturing Services – Regional Synopsis

Asia Pacific EMS market is anticipated to claim a 59% revenue share by 2027, driven by robust semiconductor foundries and supportive policies for domestic manufacturers, particularly in key nations such as India.

The North American EMS market is expected to witness significant revenue growth, propelled by increased consumer electronics consumption in urbanized areas and substantial R&D investments.

In 2022, the global market shares for electronics manufacturing services indicated Asia Pacific leading at 45%, followed by Europe (24%), North America (16%), Middle East and Africa (9%), and South America (6%).

Electronics Manufacturing Services Recent Trends and Developments

In 2021, Celestica Inc. acquired PCI Private Limited, a Singapore-based electronics manufacturing services (EMS) provider, to develop its telematics, IoT, embedded systems, and human-machine interface.

In 2022, Foxconn announced a USD 1 billion investment in a new semiconductor facility in Arizona, USA, reflecting the near-shoring critical electronics manufacturing trend.

In 2022, Wistron Corporation joined Arrival Ltd. to establish a joint venture for manufacturing electric buses in Vietnam, showcasing EMS players’ increasing involvement in the EV sector.

In 2023, Hon Hai Precision Industry Co. Ltd., established a new electronics manufacturing facility in Telangana, India, as part of its global expansion plan and to deliver top-tier products to the Indian market.

In 2023, Jabil, Inc. acquired Retronix, a leader in electronic components reclamation and refurbishment, enhancing Jabil’s circular economy services.

In 2023, Sanmina Corporation expanded its capabilities in high-density interconnect (HDI) and advanced packaging technologies, strengthening its position in complex electronics manufacturing.

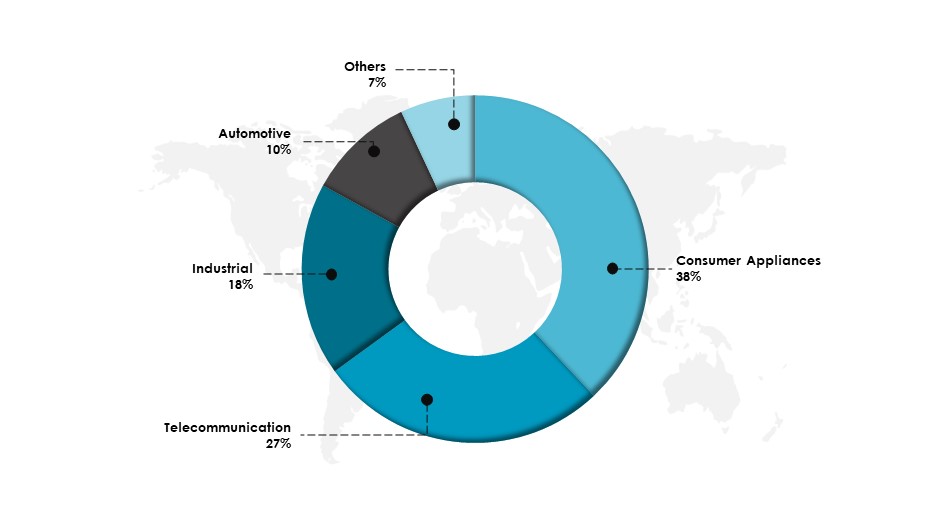

Electronics Manufacturing Services Market User-based Statistics

As per a report of 2021, the largest segment in the end-user share of electronics manufacturing services is Consumer Appliances at 38%, followed by Telecommunication (27%), Industrial (18%), Automotive (10%), and Others (7%).

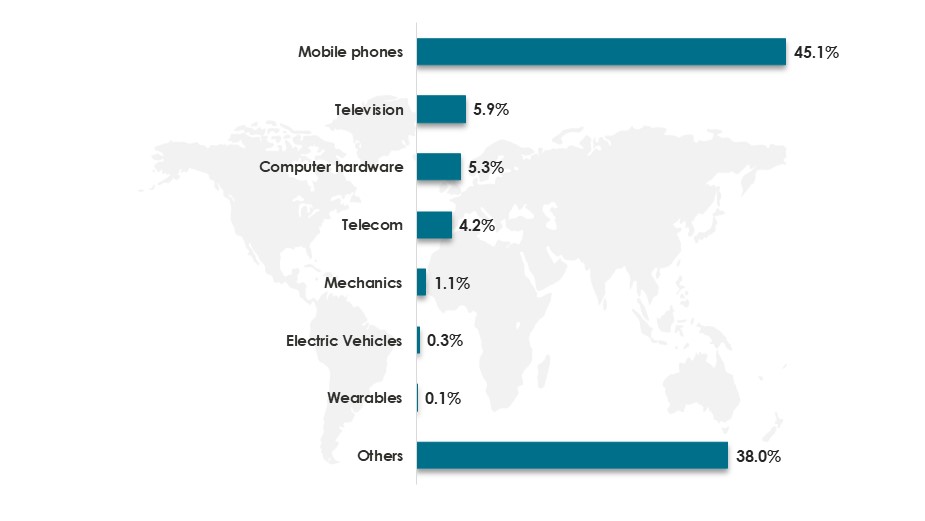

As per a report of 2022, Mobile Phones contributed to the highest share of about 45.1% of electronics manufacturing services’ consumer usage in India, followed by Television (5.9%), Computer Hardware (5.3%), Telecom (4.2%), Mechanics (1.1%), Electric Vehicles (0.3%), Wearables, (0.1%), and Others (38.0%).

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more on Manufacturing

Data Sources: Technavio, EY, Statista, FortuneBusinessInsights, Reportsinsights, and others.

Get in-depth Market Research for any industry to understand this industry in more detail where we will cover Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights