Fintech Market – Global & India

The fintech industry represents a transformative wave of digitization within the financial services sector. It encompasses many technology-driven innovations that disrupt traditional banking and finance, enabling digital payments, online lending, and more.

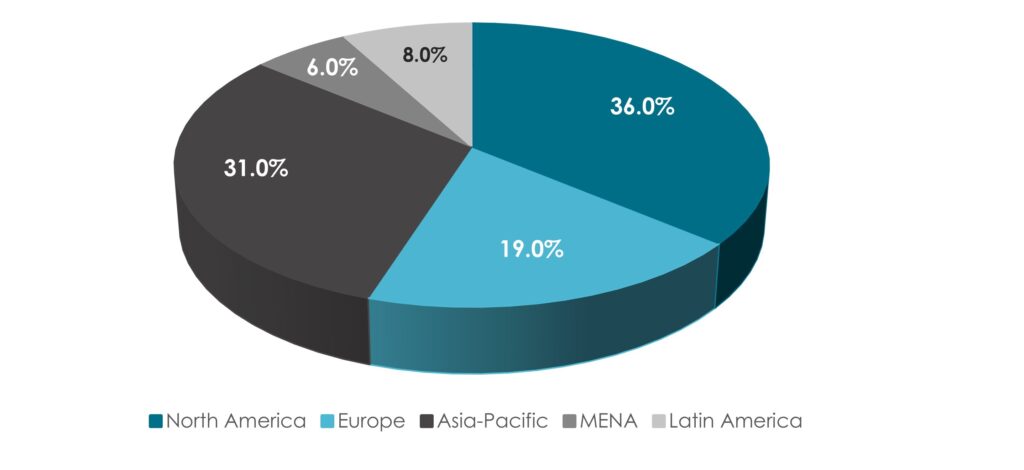

In 2022, North America accounted for 36% of the global FinTech market share, followed by APAC at 31% and South America at 8%. Further, Europe held a share of 19%, while other countries contributed 6%.

Within this global landscape, India has been emerging as a prominent player in a rapidly growing fintech market. The Indian fintech sector is set for substantial growth, driven by increasing digital adoption, government initiatives, and a large population.

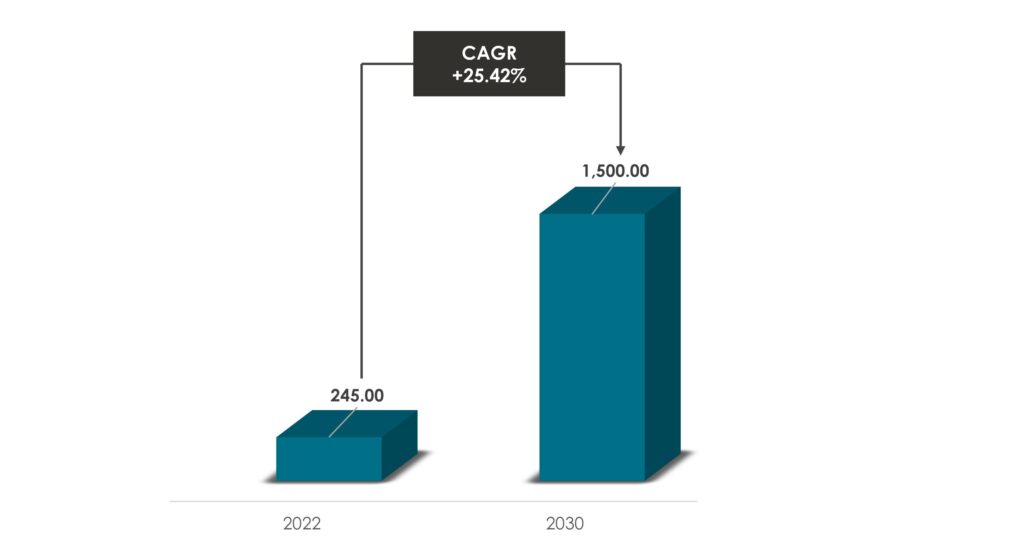

Global Fintech Market Growth and Forecast

The global fintech market is expected to experience significant growth, with a projected CAGR of approximately 25.42% from 2022 to 2030, driving its market size from $245 billion to $1.5 trillion ($1500 billion).

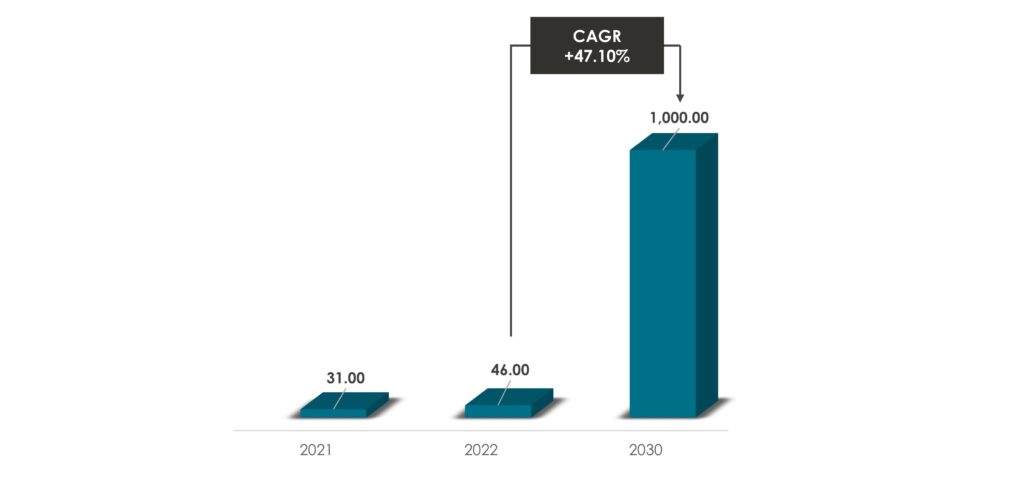

Indian Fintech Market Growth and Forecast

The Indian fintech market is projected to experience rapid growth, with a CAGR of 47.10% from 2022 to 2030, driving its valuation from $45.61 billion in 2022 to $1 trillion ($1000 billion) by 2030.

Talent Attraction in Fintech (Global & Pan-India) – Trends

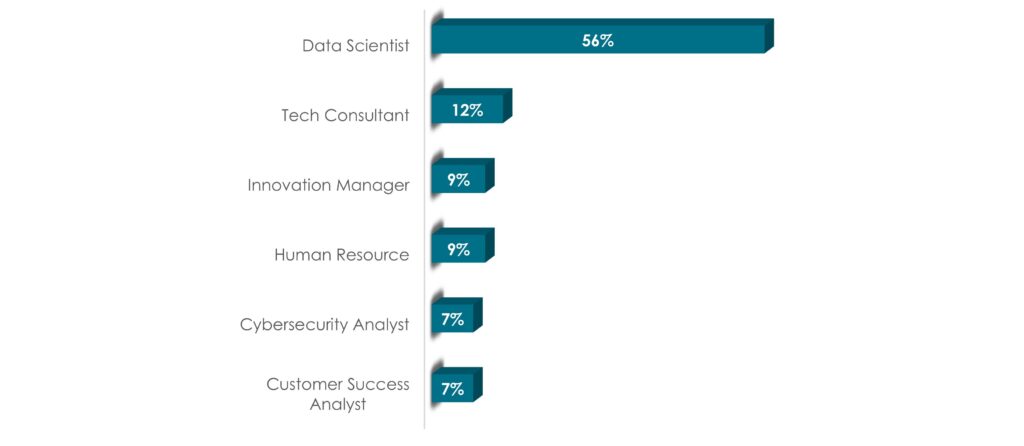

➟ Emerging Roles in the Global Fintech Industry

The Global Future Roles report showed that in 2021, around 56% of the global fintech industry were Data Scientist, followed by Tech Consultant (12%), Innovation Manager (9%), and others.

➟ High Attrition Rates in the Banking Sector and Impact on FinTech Hiring in Pan India

Between January and September 2022, the banking industry witnessed significant attrition rates, with an overall attrition of 24.7%. Domestic banks experienced a higher attrition rate of 30.6%, while foreign banks saw a rate of 16.3%.

Banks such as HDFC Bank, Axis Bank, IndusInd, and Bandhan have seen attrition rates ranging from 30% to 50%.

➟ Growing Demand for Specialized Data Roles with Increasing Job Vacancies in Global FinTech

As of February 2023, there has been a high demand for skilled data professionals in FinTech, with nearly 25,000 open data analyst vacancies in the US alone.

The tech industry faces a significant skills shortage, with 100,000 unfilled positions requiring specific skill sets.

This has led to a shift towards more specialized roles such as data engineers, analysts, automation engineers, and business intelligence analysts, catering to the industry’s need for specialized data skills.

➟ In-Demand Technical Skills Driving Fintech Talent Attraction in Pan India

Fintech companies in India are actively searching for professionals with specific technical skills to support their growth and development. Skills in full-stack development, backend and frontend development, data engineering, data analytics, software development engineering in test (SDET), mobile app development (iOS, Android), and engineering management are high demand in the Indian fintech industry.

By leveraging these skills, fintech companies can innovate, provide seamless user experiences, and drive growth in the rapidly evolving Indian fintech landscape.

MUST READ: Global Fintech Market – Market Dynamics & Statistics

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more insights here.

Data Sources: BCG, Industry ARC, Yoh, Robert Walters Group, Indigohire and others

Get in-depth Market Research for any industry to understand the Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights