The Rapid Rise of the Voluntary Carbon Credit Market

The Global voluntary carbon credit market is a system where organizations, businesses, and individuals purchase carbon credits to offset their own carbon emissions in the form of one metric ton of carbon dioxide equivalent.

Global carbon credit market impacts by incentivizing emission reductions and clean tech investment, driving corporate responsibility, serving as a market-based mechanism for change, and fostering global cooperation.

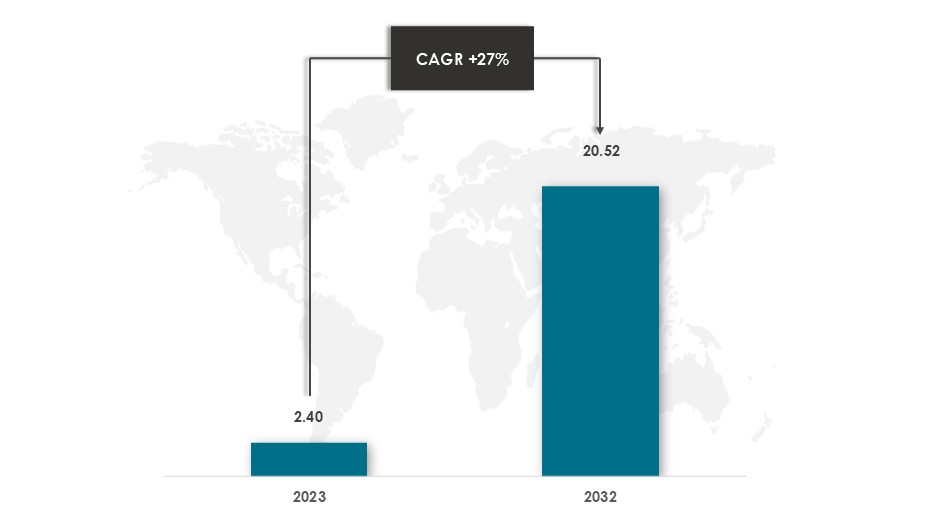

Global Voluntary Carbon Credit Market Growth and Forecast

In 2023, the Global Carbon Voluntary Carbon Credit Market was valued at $2.40 billion. The market is expected to increase and reach approximately $20.52 billion by 2032.

During the forecast period, the market is expected to grow at an approximate CAGR of 27%.

Growing need for nature-based solutions such as reforestation, afforestation, and sustainable land management aided by tech advancements such as blockchain, enhances transparency and traceability in carbon credit trading.

Global Voluntary Carbon Credit Market Recent Trends and Developments

In 2023, Climeworks, a leader in direct air capture technology, acquired Carbfix, a company specializing in carbon mineralization technology to enhance the efficiency and scalability of carbon capture and storage solutions.

In 2023, Bain & Company partnered with Sylvera to enhance transparency and growth in the voluntary carbon market, focusing on improving carbon credit quality for businesses and investors.

In 2023, The Ecosystem Marketplace Launched a new product and published The 2023 State of the Voluntary Carbon Markets report, offering insights on the latest prices, trends, and market dynamics.

In 2022, Intergovernmental Carbon Credentials (ICE) debuted Nature-Based Solutions carbon credit futures, delivering verified carbon unit credits certified under Verra’s Verified Carbon Standard to support investment in nature-based projects.

In 2022, Howden launched the world’s first voluntary carbon credit insurance product to increase confidence in the voluntary carbon market by providing insurance against the invalidation of carbon credits due to third-party negligence or fraud.

Do Subscribe to our #WeeklyMarketInsights for FREE here.

Read more Market Reports

Data Sources: GM Insights, Coherent Market Insights, Grand View Research, Global Market Estimates, BCG, Bain, and others.

Get in-depth Market Research for any industry to understand this industry in more detail where we will cover Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Other Market Insights