Implementation of Metaverse in Banking

Introduction

The term “metaverse banking” refers to the dealing of financial transactions in digital environments. Banking has joined the metaverse, allowing customers to buy cryptocurrencies and use services online. Metaverse banks might offer guidance and develop relationships at this time when banking has become commoditized and devoid of emotional salience.

According to Gartner’s forecast, approximately 26% of people in the world will be spending at least an hour per day in the metaverse for work, shopping, education, social, and entertainment by 2026. The banks are putting up lobbies, games, and ways to transact game tokens for cash. According to a report, 47% of bankers expect clients will use AR/VR for transactions by 2030. The banks that participate in the metaverse will be able to take advantage of a wide variety of new opportunities.

According to Sonali Kulkarni, Lead Financial Services at Accenture India, “Besides its potential regarding product and service innovation in payments, investment, insurance and loans, the metaverse is an opportunity for banks to foster deeper customer connects.”

According to Rajesh Mirjankar, CEO of Kiyaverse, “While digital banking is functionally interdependent and inclusive, it is all too often seen as being emotionally detached. The metaverse allows banks to use cutting-edge technology with a human touch that will significantly deepen and personalize customer interaction. It is an opportunity to restore the dialogues lost in digital channels.”

Benefits

Some of the benefits that are received from implementing metaverse in the banking sector are as follows:

➟ Customer and Employee Experience – Using AR and VR technologies, banks can provide their customers and employees with 3D experiences. Customers may check accounts, make payments, and transfer funds, via AR / VR. It can also offer immersive learning experiences in simulated consumer situations or onboard remote employees.

➟ New Market – With metaverse, banks may virtualize consumer interactions including ATM transactions, branch stores, and event sponsorships. After meeting with their avatar adviser, people may go to an ATM, input their PIN to fund their virtual wallet, and then make a purchase.

➟ Customer Engagement – Banks may give personalized advice and establish trust. Customers might use an avatar at home or visit a metaverse branch. It may include virtual yearly portfolio assessments, financial planning meetings, and mortgage suggestions.

➟ Marketing – Banks may virtualize brand interactions including ATM withdrawals, branch location, branding, and endorsements to bring environmental, social, and governance credentials to life. In the metaverse, marketing will be with customers. As customers become metaverse collaborators, marketing will move from defining to partnering.

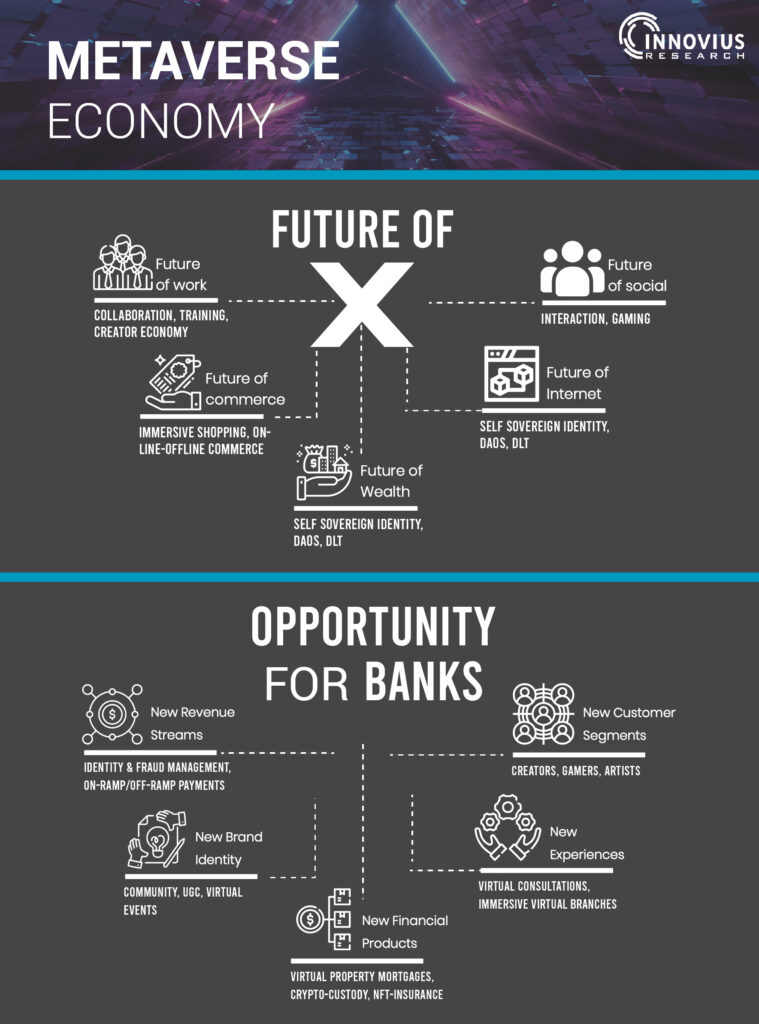

Banks’ Opportunities and Outcomes in the Metaverse Economy

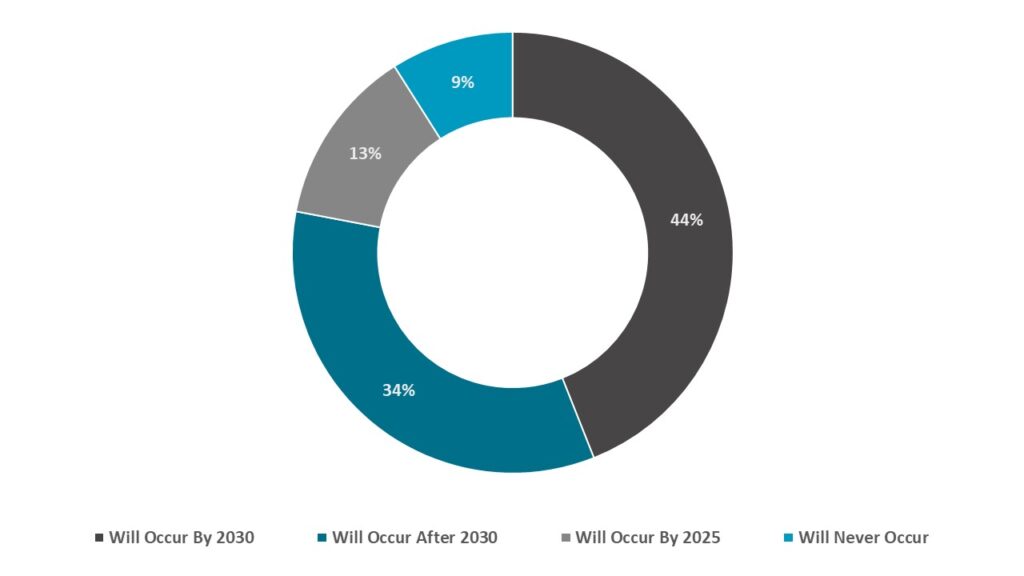

According to the Digital Banking Report 2021, a survey was conducted regarding the use of metaverse technologies by consumers for banking. It was noticed that around 44% of the financial leaders predicted that the adoption of such technologies by consumers will occur after 2030, while 34% of financial leaders predicted that the adoption of such technologies will occur by 2030.

Consumer Use of Virtual and Augmented Reality for Transactions

Banking Metaverse Projects

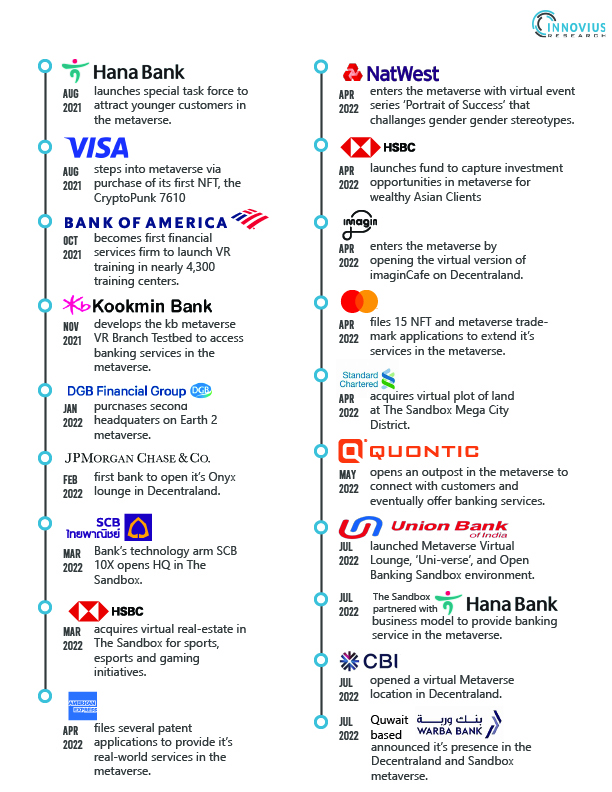

➟ In 2022, JPMorgan Chase opened a metaverse lounge and workplace. The luxurious area premiered on Decentraland alongside a report from the bank’s blockchain subsidiary Onyx that highlighted the future of the metaverse.

➟ In 2022, HSBC made stated its intention to establish a workplace in the metaverse on Sandbox. HSBC’s land will be utilized its land to interact with people who are passionate about sports, esports, and gaming.

➟ Quontic is an adaptive digital bank with virtual offices. Its 2022 debit card includes cash and high-interest accounts and Bitcoin checking reward accounts.

➟ In 2022, American Express submitted trademark applications for a virtual marketplace and services related to cryptocurrencies in the metaverse. It has filed applications for real-world services in the digital world, such as card payment services, ATMs, banking and fraud monitoring services, entertainment, travel, etc. for its virtual clients.

➟ In June 2022, a Mumbai-based fintech firm called ‘Kiya.ai’ established India’s first banking metaverse, branded ‘Kiyaverse’ for banks and non-banking financing companies (NBFCs) to use for various analytics-based services. Individual users will be able to establish virtual avatars and connect with banks on the platform to access various banking services through Kiyaverse.

Metaverse in Banking

Risks of the Metaverse for Banks

Metaverse, similar to social media or real-world interactions, may expose brands, including banks, to a variety of reputational and legal problems.

The nature or scope of them may be difficult to predict at this early stage. Banks should brace themselves for intense regulatory scrutiny of the metaverse and be ready to respond quickly to new legislation. Trust will be critical to the acceptance of the new experiences that banks and other brands are developing.

Data Sources: The Financial Brand, Times Of India, Profinch, Wunderman Thompson, American Banker, Analytics India Mag, Whitesight, and many more

Get in-depth Market Research for any industry to understand the Market Size, Competitors, Trends, Drivers and Challenges, Future forecasts, SWOT analysis, TAM, SAM or SOM, and much other information in detail. Get in touch with us today.

Must Read