Impact on Aviation Market – Ukraine-Russia Conflict

Introduction

Just when the aviation market was regaining its footing with the relaxation of COVID-19 limitations, air travel is expected to be hampered once again due to the Russia-Ukraine crisis. High oil prices, fewer customers owing to the pandemic, and the possibility of conflict or war are a triple whammy from which airlines will struggle to recover fast.

According to Rob Morris, Chief Consultant at UK-based Ascend by Cirium, Russia’s invasion has significant potential to derail the fragile airline recovery in Europe.

Present Situation and Impact

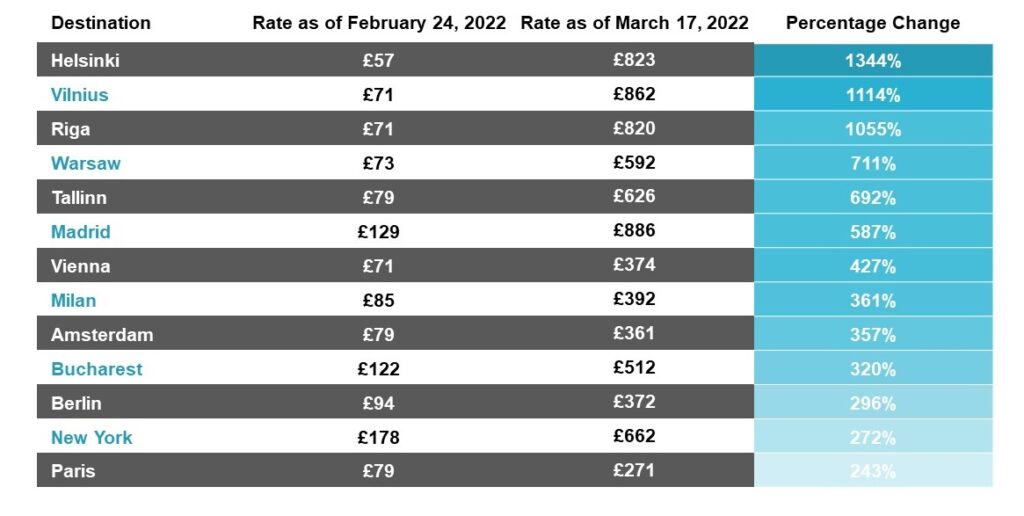

Increased flight fares – Recently, data from Google Flights showed that the prices of flights out of Russia have been soaring following the sanctions. Hence, as a result, Russians looking to travel to Europe are faced with often unaffordable prices for their tickets. This will also harm several touristic destinations that are favored by Russian tourists.

Titanium shortage – Titanium is a vital metal in aircraft manufacturing. As Ukraine and Russia are among the world’s major producers of titanium, a disruption in supply may hamper aircraft and engine makers’ manufacturing lines. A titanium scarcity might result from manufacturers refusing to buy it to put pressure on the Russians, or it might be the Russians cutting off supplies in retaliation for the restrictions imposed on them. In either case, eliminating some or all of the Russian titanium would pose a significant challenge to airline manufacturers and, ultimately, airlines.

Airspace closure – According to IBA Consultants, Russia accounted for 6% of airline capacity in 2021. Russia has now blocked its airspace to 36 nations, including all 27 EU members, resulting in a 42% decrease in flights to/from Europe traveling across Russian airspace. Ukraine’s airspace is likewise devoid of aircraft. Even the European Union has declared that all Russian-owned, Russian-registered, or Russian-controlled aircraft would be barred from using its airspace. The United Kingdom followed suit and barred Russian planes from its airspace, prompting Russia to restrict all UK aircraft from its airspace. The US Department of Transportation and its Federal Aviation Administration issued directives on March 2, 2022, prohibiting Russian aircraft and airlines from entering and utilizing all domestic US airspace.

Russia issued a NOTAM (notice to air missions) prohibiting civil flights from flying over Ukraine’s northeastern border. This encompasses a stretch of an area where Russian forces have concentrated. Simultaneously, Ukraine restricted its airspace to passenger flights. Civilian air traffic tracking sites now reveal that airlines are avoiding crisis zones by a considerable margin

Disruption to Commercial Air Travel on a Massive Scale – Airlines will now incur more fuel, maintenance, and logistical expenses while attempting to recover from the pandemic’s consequences. According to ICF International Inc., diversions around Ukraine will cost airlines an extra $1.5 million every week. The loss of overflight fee revenue will be terrible for Ukraine.

Cargo traffic snarls – Airspace closures and aircraft delays have already begun to impact cargo transportation, compounding global supply-chain concerns. Many freight planes utilize Russian airspace, which serves as a vital crossroads for world commerce. United Parcel Service (UPS) and FedEx Corp (FDX) of the United States have joined Lufthansa Cargo of Germany in suspending deliveries to Russia.

Chaos in the global supply chain – Cancellation and diversion of cargo airlines have placed global supplies of essential components for a number of goods, including platinum, aluminum, sunflower oil, and steel components at risk.

The collapse of the Russian Aviation Industry – At the start of 2022, Western-made aircraft, including Boeing and Airbus, accounted for over 80% of Russia’s fleet. Many of those planes will be grounded in the coming months as a result of Western nations’ ban on exporting aviation technology, including spare parts, to Russia after its invasion of Ukraine. Analysts predict that Russia’s airlines will be compelled to cannibalize their existing fleets for spare parts.

Cancellation Rates In Bookings

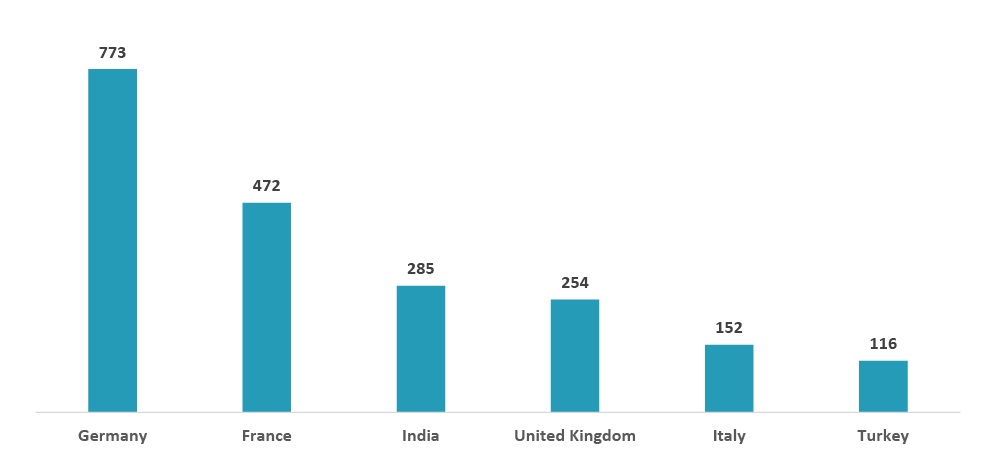

According to research, as of February 2022, Germany had the highest cancellation rate of 773%, followed by France and India. Furthermore, Cyprus had the highest cancellation rate for inbound flights from Russia.

Data Sources: Money Control, Forbes, Airport Technology, Yahoo News, Flyingmag, and others

To know more about this market study Contact Now

Read more Market Reports